Saving for Retirement: A Step-by-Step Guide to Securing Your Future

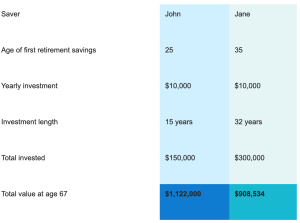

As we journey through life, it’s important to plan for our retirement years. Saving for retirement is a crucial aspect of financial planning, and the earlier you start, the better off you’ll be in the long run. Whether you’re just beginning your career or are already well into it, it’s never too late to start saving for retirement. Here’s a step-by-step guide to help you on your path to a secure retirement.

Verify my mortgage eligibility (Jul 27th, 2024)Set Clear Retirement Goals:

The first step in saving for retirement is to define your retirement goals. Ask yourself questions like when you want to retire, what kind of lifestyle you want to have, and what activities you plan to do during your retirement years. Having a clear vision of your retirement goals will help you determine how much money you’ll need to save.

Create a Budget:

Creating a budget is a crucial part of managing your finances effectively. It allows you to track your income and expenses, and identify areas where you can cut back and save more. Start by listing all your monthly income sources and expenses, including fixed expenses like rent/mortgage, utilities, transportation, and groceries, as well as variable expenses like entertainment, dining out, and discretionary spending. Set a realistic budget that prioritizes saving for retirement as one of your key financial goals.

Take Advantage of Retirement Accounts:

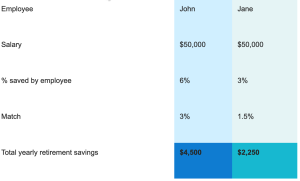

Retirement accounts, such as 401(k)s, IRAs, and Roth IRAs, are powerful tools for saving for retirement. Take advantage of these tax-advantaged accounts as they offer benefits like tax-deferred or tax-free growth, depending on the type of account. Contribute the maximum amount allowed by the IRS to take full advantage of employer matches and tax benefits. If you’re self-employed, consider setting up a SEP-IRA or a Solo 401(k) to save for retirement.

Verify my mortgage eligibility (Jul 27th, 2024)Diversify Your Investments:

Diversification is a key strategy for managing risk in your retirement portfolio. Spread your investments across different asset classes, such as stocks, bonds, and real estate, and diversify within each asset class as well. This can help reduce the impact of market volatility on your portfolio and increase the potential for long-term growth. Consider working with a financial advisor to create a diversified investment plan that aligns with your risk tolerance and retirement goals.

Minimize Debt and Expenses:

Reducing debt and minimizing unnecessary expenses can free up more money to save for retirement. Pay off high-interest debts, such as credit card debt and student loans, as soon as possible to save on interest charges. Look for ways to cut back on non-essential expenses, such as eating out less, canceling unused subscriptions, and finding cost-effective ways to enjoy your hobbies. Redirect the money saved towards your retirement savings.

Keep an Eye on Inflation:

Inflation erodes the purchasing power of your money over time, and it’s important to account for it when planning for retirement. Make sure your investment portfolio includes assets that have historically outpaced inflation, such as stocks and real estate. Regularly review your retirement plan and make adjustments to your savings and investment strategy to keep up with inflation and ensure your retirement savings remain on track.

Verify my mortgage eligibility (Jul 27th, 2024)Stay Disciplined and Consistent:

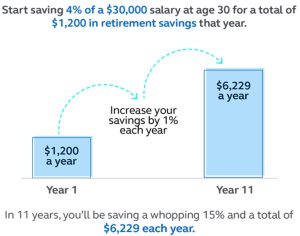

Saving for retirement requires discipline and consistency. Avoid the temptation to dip into your retirement savings for other purposes and stay committed to your retirement goals. Automate your savings by setting up automatic contributions to your retirement accounts and increase your savings rate whenever possible, such as when you receive a raise or a bonus. Stay informed about your investments and periodically review your retirement plan to make sure you’re on track.

Saving for retirement is a crucial aspect of financial planning and requires careful consideration. Thank you for joining me today!!

Show me today's rates (Jul 27th, 2024)